‘The money you make is a symbol of the value you create’

Idowu Koyenikan

We know how vital it is for your customers to pay in full, on time, every time. Apart from the wasted effort spent chasing outstanding invoices, a reliable cash flow is the lifeblood of any business, ensuring you can fulfil your financial obligations.

A healthy cash flow also allows you to invest in opportunities as they arise from training, taking advantage of unexpected marketing opportunities, trialling new software, or simply rewarding your team with staff benefits.

In this article, we’ll cover off

- The importance of getting paid on time

- How significant a problem is a bad debt

- Common reasons for non-payment

- How to reduce bad debt

We’ve written it so that you can read it from start to finish or jump to the section that is most interesting to you.

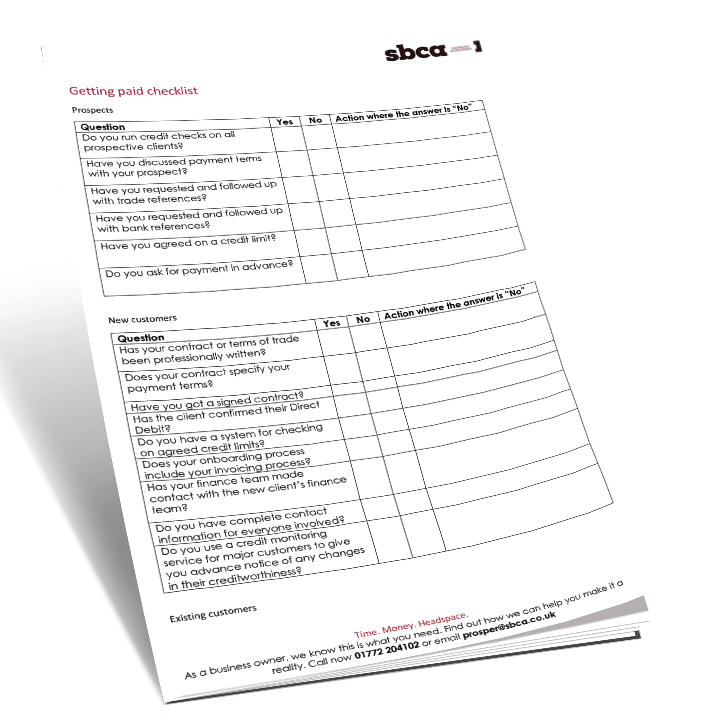

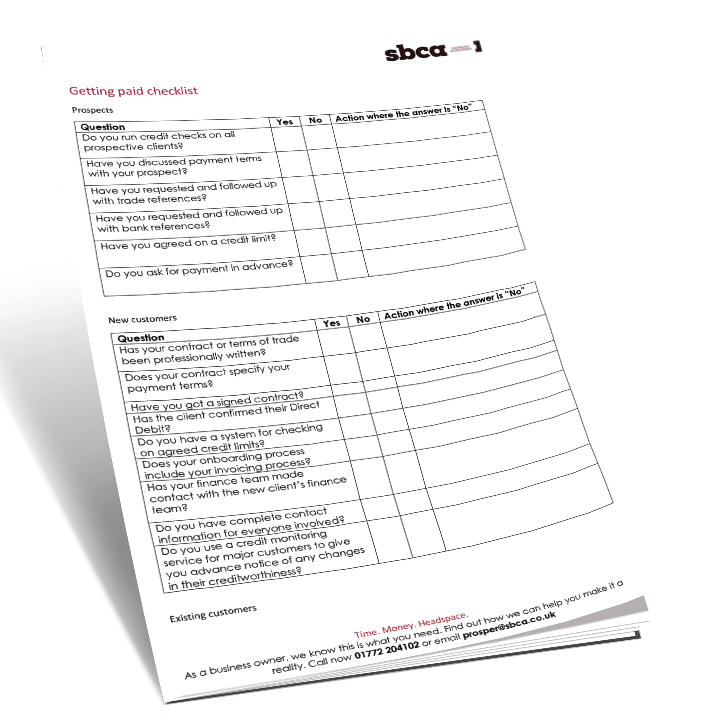

Get Yours Here.

The importance of getting paid on time:

Late payments can have several adverse effects on businesses, including:

- Reduced Cash Flow: This can make it challenging to meet your financial obligations.

- Increased Costs: If you can’t fulfil your financial obligations, you might suffer late payment charges. If things get more serious, there is also the cost of chasing late payments, such as team salaries and legal/debt collection fees.

- Damaged Relationships: The knock-on impact of late payments could hurt your relationships with the people and suppliers who rely on you paying them. Also, while you might not care at this point if your relationship with a client who is not paying you is damaged, wouldn’t it be better to have processes in place that avoids these discussions in the first place?

- Wasted Time: Arguably worse than wasting money chasing late payments is the wasted time it involves. All those hours spent in meetings, on the phone, or writing emails could be time spent on winning new business, networking, or working on efficiency improvements.

How significant a problem is a bad debt?

Recent research conducted by Bibby Financial Services found that of the businesses polled, 27% have been forced to write off bad debt.

The study also showed that, on average, SMEs write off £11,829 as bad debt.

Explaining the consequences of bad debt, Bibby Financial Services’ Global Chief Executive, David Postings, stated that

“a chronic problem [of bad debt] for SMEs [which] can lead to staff cuts, delayed investment plans and – at worst – insolvency.”

British Business Bank found that 54% of the UK’s small and medium-sized businesses suffer from late payments. Research from Pay UK shows that an estimated £23.4 billion of late invoices are owed to these firms.

Get Yours Here.

What are the common reasons non-payment

Before we discuss ways of preventing bad debt, we need to understand the common reasons why businesses don’t pay their invoices. After all, you don’t want to ruin a relationship with a good customer by being too aggressive too quickly when they’ve made a simple mistake.

Below are the results from a study that asked businesses for their reasons for not paying an invoice:

- 23% Waiting for the cheques to be signed*

- 22% of Invoices were lost

- 16% Cash flow problems

- 15% Person dealing with it is unavailable or off sick

- 6% Cheque is in the post

- 5% Waiting for the cheque run or a new chequebook

- 3% The invoice is being disputed

- 2% We pay on 60/90 days – not 30 days

- 2% Missed the payment run

*We were surprised by how many companies are still using cheques too!

Most, if not all, of these reasons can be put down to simple communication problems. Our tips aim to rule out these reasons early in the relationship.

By doing this, you can get advanced warning of a business that never had any intention of paying and limit your exposure quickly.

How can businesses reduce bad debt?

So, now we have a solid understanding of the scope of the problem, the issues it can cause, and the common reasons for non-payment, let’s look at how you can avoid bad debt.

Before Contracts Are Signed

Run a credit check: Before accepting them as a new customer, run a credit check on a business. This will give you insights into their financials, provide a risk score, and tell you of any liabilities or bankruptcies. If you find something concerning, you might want to insist on payment upfront before starting any work.

It can be a good idea to run credit checks at the start of the sales process. Then if any red flags are raised, you can decide how you want to proceed.

Agree on payment terms in writing: Many businesses avoid discussing payment terms as they feel it might lose them the sale. A simple way to get around this is to explain your finance team has a set process for raising and chasing invoices. If the client has a different payment approach, you need to make your team aware.

This is usually a light-touch approach for uncovering any issues. It also gets the payment terms agreed in writing, so if there are problems in the future, you’ve got a comeback to fight your corner.

Be selective: If you find a new client has payment terms that are difficult to accept, don’t be afraid to bring it up. This most commonly manifests in businesses wanting to pay in 60 or 90 days. Some will also insist on invoices only being raised once the work has been completed. This could mean you’re left financing the job for months or more before getting paid.

Regardless of the size of the contract, how will this impact your cash flow, and can you accept the chance this turns into bad debt? Don’t be afraid to walk away if the risks are too severe.

Setup direct debits: If possible, request the client pays via direct debit. This can be positioned to save both you and the client time. It can also weed out any concerns they might have. After all, why would they not want to go on direct debit?

Get a signed contract: An absolute must. No work should ever begin before contracts are signed. As well as your payment terms, it should detail how you handle bad debts, when/if interest will be applied, and how long you will hold a debt before passing it to a collection agency.

After contracts are signed

On-boarding: Most businesses have onboarding processes that include things the client needs to provide. Start including a document detailing the invoice process as you understand it (see above for tips on getting this information).

It would help if you also had some blank fields for things like PO numbers, who to send invoices to, when invoices must be submitted, and any specific wording required on your invoices.

Leverage associations: Don’t underestimate the value of building a relationship with the client’s finance team. Most people will ignore them at best or write hostile chasing emails at worst.

Be the exception and make them feel part of the process. Greet them, tell them you’re looking forward to working with them, but most importantly, confirm the payment process as you understand it, and ask if there’s anything else they need.

However, always look to foster this relationship, not just at the start. They might not always have the authority to process your invoice, but at the very least, they might give you insights into the problem.

Automate invoicing and follow-up: Using a software package that can automate invoicing and follow-ups saves time and removes human error in the creation of invoices. This is especially valuable for businesses that provide subscription services or require regular monthly payments. Ask any member of our team how to set up automatic invoice reminders in Xero.

When bad debt occurs

Review debtors: No matter what you do, late payments will happen. Dedicate part of your Senior Leadership Team meetings to discussing invoices. You should be asking;

- Who is due to pay this month?

- Are we on track to deliver the agreed work to avoid disputes? If not, what can we do to change this?

- Who are the late payers, and why are they not paying?

- Who’s chasing them, and are there any updates from last week’s meeting? If not, why not?

- Does the issue need to be escalated? If so, what’s the next action, and who’s responsible for making this happen?

Agree on escalation points: Agree on an internal process for how and when a late payment issue will be escalated. For example, the first escalation might be a friendly nudge from your Account Manager to their primary contact. Next, your finance team might contact the client’s finance team a week later. Finally, after three weeks, the issue might be escalated to a Director to put a call into their counterpart.

This process reduces the time discussing late payments and means people can be as efficient as possible. It also avoids multiple people contacting the client with different tones and messages.

Stay calm: Whatever you do, don’t telephone debtors in an angry mood. Making bold demands risks alienating the people who owe you money when you should be persuading them. So instead, keep calm and rehearse what you’re going to say to ensure you hit the right tone.

Are you ready to get your system updated?

Yes? Good. We’re on your side. We’ve put together a checklist that will help you get organised quickly. Enter your details below to receive your copy now.